Use these links to rapidly review the document

TABLE OF CONTENTSTable of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

UNITED STATES

| | |

SECURITIES AND EXCHANGE COMMISSION

|

Washington, D.C. 20549

|

|

SCHEDULE 14A

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

Filed by the Registrantýx |

|

Filed by a Party other than the Registranto

|

|

Check the appropriate box:

|

o | | Preliminary Proxy Statement |

o |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

| | | | |

|

|

DUKE ENERGY CORPORATION

|

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box):

|

x

ý | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)

| (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2)

| | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3)

| | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4)

| | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5)

| | | |

| | (5) | | Total fee paid: |

| | | | |

o

| | | | |

| o | | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)

| (1) | | Amount Previously Paid: |

| | | | |

| | (2)

| | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3)

| Filing Party:

| | |

| | (3) | | Filing Party: |

| (4)

| Date Filed:

| | |

| | | | | |

| | (4) | | Date Filed: |

| | | | |

| | | | | |

Table of Contents

| | | | |

| | | Welcome to the

Duke Energy Annual

Shareholder Meeting | Meeting of Shareholders |

|

|

March 20, 201426, 2015

Dear Fellow Shareholders:

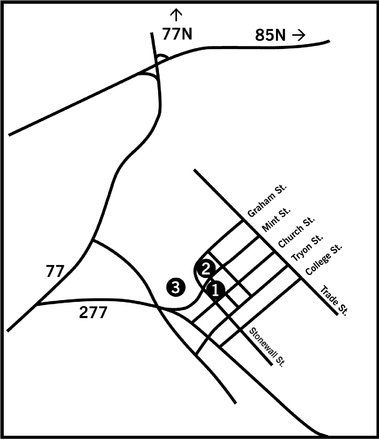

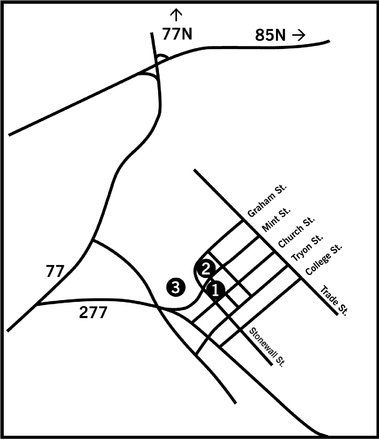

I am pleased to invite you to our annual shareholder meetingAnnual Meeting of Shareholders to be held on Thursday, May 1, 2014,7, 2015, at 10:00 a.m. in the O.J. Miller Auditorium located at 526 South Church Street in Charlotte, North Carolina.

As explained in the enclosed proxy statement, at this year's meeting you will be asked to vote (i) for the election of directors, (ii) for the ratification of the selection of the independent public accountant, (iii) for the approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation, (iv) for the amendment toapproval of the Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent,Corporation 2015 Long-Term Incentive Plan, (v) against twothree shareholder proposals, and (vi) to consider any other business that may properly come before the meeting.

This year's proxy statement includes certain items such as a proxy statement summary on page 6 and certain charts and illustrationsdetails the many steps we have undertaken, beginning in 2014, to help better explainexpand our strong corporate governance practices. We have conducted a significant outreach campaign this year to speak directly with a number of our shareholders about various matters, including executive compensation and compensation programsboard oversight of critical issues facing Duke Energy. Consistent with shareholder feedback, we have implemented several new shareholder friendly changes to our governance practices. These steps are in addition to the many exciting developments and objectives. With this document, our aim is to communicate with youopportunities Duke Energy has been involved in, which will be detailed in the matters to be addressed at the meeting in a way that is simple and straightforward.2014 Annual Report.

Your vote is important – exercise your shareholder right and vote your shares right away.now.

Please turn to page 123 for the instructions on how you can vote your shares over the Internet, by telephone or by mail. It is important that all Duke Energy shareholders, regardless of the number of shares owned, participate in the affairs of the Company. At Duke Energy's 20132014 Annual Shareholder Meeting of Shareholders, approximately 84 percent of the Company's outstanding shares were represented in person or by proxy.

We hope you will find it possible to attend this year's annual shareholder meeting and thankThank you for your continued interestinvestment in Duke Energy.

Sincerely,

Lynn J. Good

Vice Chairman, President and Chief Executive Officer

Table of Contents

Table of Contents

| | | DUKE ENERGY – 2015 Proxy Statement |

Table of Contents

PARTICIPATE IN THE FUTURE OF DUKE ENERGY;

CAST YOUR VOTE RIGHT AWAYNOW

It is very important that you vote to play a part in the future of Duke Energy. New York Stock Exchange ("NYSE") rules state that if your shares are held through a broker, bank or other nominee, they cannot vote on your behalf on nondiscretionary matters.

Please cast Eligibility to Vote (page 79)

You can vote if you were a shareholder of record at the close of business on March 9, 2015.

Vote Now

Even if you plan to attend this year's meeting, it is a good idea to vote your shares now, before the meeting, in the event your plans change. Whether you vote right away onby Internet, by telephone or by mail, please have your proxy card or voting instruction form in hand and follow the instructions.

| | | | |

By Internet using

your computer |

|

By telephone |

|

By mailing your

proxy card |

|

|

|

|

|

Visit 24/7

www.proxyvote.com | | Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares are not

registered in your name | | Cast your ballot,

sign your proxy card

and send free of postage |

|

|

|

|

|

Visit Our Website

| | |

Visit our website

www.duke-energy.com/investors/news-events.asp | | • Review and download this proxy statement and our annual report

• Listen to a live audio stream of the meeting |

| | | DUKE ENERGY – 2015 Proxy Statement 3 |

Table of Contents

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the proposals listed belowinformation that you should consider. You should read the entire proxy statement carefully before voting. Page references ("XX") are supplied to ensure that your shares are represented.

help you find further information in this proxy statement.

Proposals That Require Your Vote Voting Matters (page 10)

| | | | | | | | | | | | |

| |

| | More

information

| | Board

recommendation

| | Broker non-votes

| | Abstentions

| | Votes

required

for approval

|

|---|

| |

|---|

| PROPOSAL 1 | | Election of directors | | Page 1511 | | FOR each nominee | | Do not count | | Do not count | | Majority of votes cast, with a resignation policy |

|

PROPOSAL 2 |

|

Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 20142015 |

|

Page 3334 |

|

FOR |

|

Vote for |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 3 |

|

Approval, on an advisory basis, ofAdvisory vote to approve Duke Energy Corporation's named executive officer compensation |

|

Page 3536 |

|

FOR |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 4 |

|

Approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consentCorporation 2015 Long-Term Incentive Plan |

|

Page 6865 |

|

FOR |

|

Do not count | | Vote against |

|

Vote against |

|

Majority of outstanding shares entitled to voterepresented |

|

PROPOSAL 5 |

|

Shareholder proposal regarding shareholder right to call a special shareholder meetinglimitation of accelerated executive pay |

|

Page 6972 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 6 |

|

Shareholder proposal regarding political contribution disclosure |

|

Page 7175 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

| PROPOSAL 7 | | Shareholder proposal regarding proxy access | | Page 77 | | AGAINST | | Do not count | | Vote against | | Majority of shares represented |

|

| 4 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

2014 Business Highlights

2014 was a year of challenges, but also a year that showed the great resolve and determination of Duke Energy as the Company continued to advance its strategy and deliver significant benefits to its customers, investors, communities and employees:

- •

- First, safety, which is our top priority. We did not meet our objective for no employee and contractor fatalities in 2014 as we tragically lost four teammates during the year. Our goal is for each of our employees and contractors to return safely to their families each day. Our performance in this area during 2014 was not acceptable and we are refocusing our efforts in 2015.

- •

- The efficient, reliable and safe operational performance of our fleet and grid is critical to the service we provide to our customers. Our nuclear fleet of 10,500 megawatts achieved a capacity factor of approximately 93%, the 16th consecutive year above 90%. Additionally, our system met record customer demands during the 2014 polar vortex, and we quickly and safely responded to over 1.7 million customer outages following two major ice storms in February and March. We also continued to achieve significant savings from our 2012 merger with Progress Energy. We are well on track to achieve the $687 million customer fuel and joint dispatch savings commitment we made to Duke Energy's customers in the Carolinas over the first five years of the merger. The efficiency and diversity of our system helps us maintain customer rates below national averages in each of our jurisdictions.

- •

- We made significant progress in advancing our coal ash management practices as we responded to the early February 2014 coal ash accident at our Dan River site. We have begun to accelerate plans to close ash basins across our system. We have formed a new internal organization to manage all coal combustion products and an advisory board of independent experts in engineering, waste management, environmental science and risk analysis.

- •

- We advanced $8 billion in growth initiatives during the year as we made investments to continue to meet the needs of our customers in the future. These investments consist of new gas-fired and solar generation in our regulated businesses, natural gas pipeline infrastructure and upgrades to the grid.

- •

- During the year, we made strides to tighten our strategic alignment. In February, we announced an intent to exit our Midwest commercial generation business. In August, we announced an agreement to sell this portfolio of nonregulated assets to Dynegy for $2.8 billion in cash. We are still awaiting final Federal Energy Regulatory Commission approval and expect to close the transaction by mid-2015.

- •

- We achieved strong financial performance during 2014, which is important to maintaining the confidence of our investors.

- o

- We increased our quarterly dividend payment by approximately 2% during the year, the seventh consecutive year of annual dividend growth. Additionally, 2014 was the 88th consecutive year Duke Energy paid a quarterly cash dividend on its common stock. At the end of 2014, our dividend yield was approximately 3.8%.

- o

- We achieved a total shareholder return ("TSR") of 26.4% compared to the 28.9% TSR of the Philadelphia Utility Index.

Board Representation

| | | DUKE ENERGY – 2015 Proxy Statement 5 |

Vote Right Away

Table of Contents

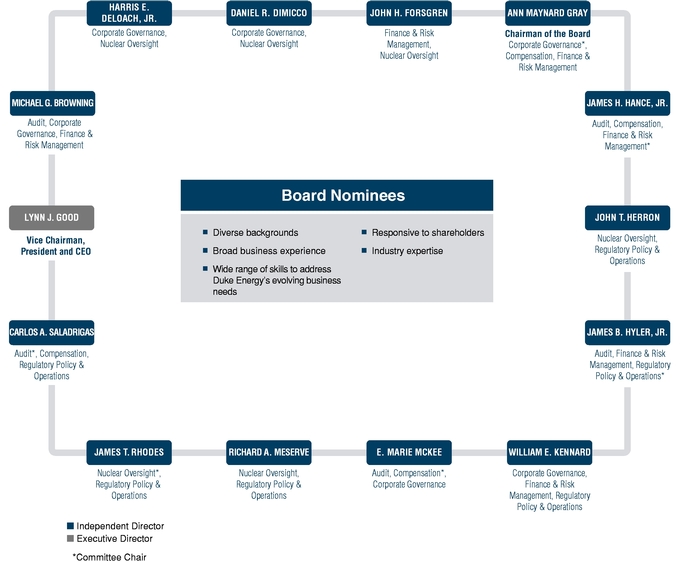

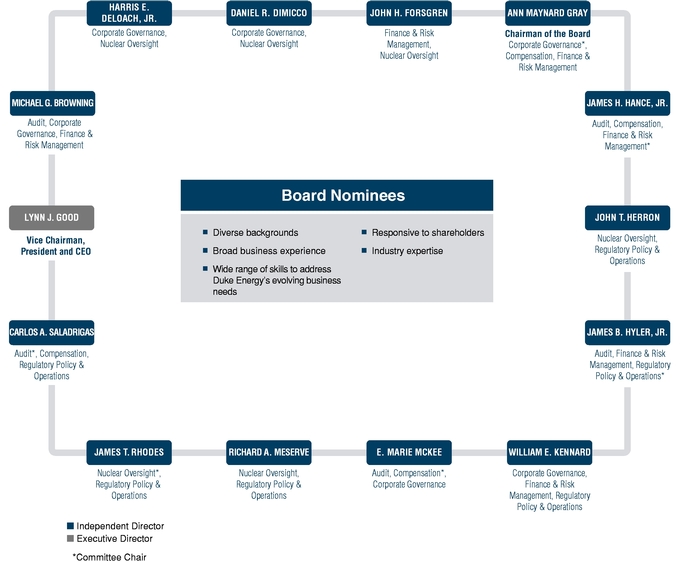

Board Nominees (page 11)

| | | | | | | | | | | | | | |

| |

| |

| |

| | Independent (Yes/No) | |

| |

|

|---|

| |

| | Director since

| |

| | Committee Memberships

| | Other Public

Company Boards

|

|---|

Name

| | Age

| | Occupation

| | Yes

| | No

|

|---|

| | | | | | | | | | | | | | | |

Michael G. Browning | | 68 | | 2006 | | Chairman, Browning Consolidated, LLC | | X | | | | • Audit • Corporate Governance • Finance and Risk Management | | • None |

| | | | | | | | | | | | | | | |

Harris E. DeLoach, Jr. | | 70 | | 2012 | | Executive Chairman, Sonoco Products Company | | X | | | | • Corporate Governance • Nuclear Oversight | | • Sonoco Products Company |

| | | | | | | | | | | | | | | |

Daniel R. DiMicco | | 64 | | 2007 | | Chairman Emeritus, Retired President and Chief Executive Officer, Nucor Corporation | | X | | | | • Corporate Governance • Nuclear Oversight | | • None |

| | | | | | | | | | | | | | | |

John H. Forsgren | | 68 | | 2009 | | Retired Vice Chairman, Executive Vice President and Chief Financial Officer, Northeast Utilities | | X | | | | • Finance and Risk Management • Nuclear Oversight | | • The Phoenix Companies, Inc. |

| | | | | | | | | | | | | | | |

Lynn J. Good

Vice Chairman |

| 55 | | 2013 | | Vice Chairman, President and Chief Executive Officer, Duke Energy Corporation | | | | X | | None | | • Hubbell Incorporated |

| | | | | | | | | | | | | | | |

Ann Maynard Gray

Chairman of the Board | | 69 | | 1997 | | Retired Vice President, ABC, Inc. and President, Diversified Publishing Group, ABC, Inc. | | X | | | | • Compensation • Corporate Governance • Finance and Risk Management | | • The Phoenix Companies, Inc. |

| | | | | | | | | | | | | | | |

James H. Hance, Jr. | | 70 | | 2005 | | Retired Vice Chairman and Chief Financial Officer, Bank of America Corporation | | X | | | | • Audit • Compensation • Finance and Risk Management | | • Acuity Brands, Inc. • Cousins Properties Incorporated • Ford Motor Company • The Carlyle Group, LP |

| | | | | | | | | | | | | | | |

John T. Herron | | 61 | | 2013 | | Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | • None |

| | | | | | | | | | | | | | | |

James B. Hyler, Jr. | | 67 | | 2012 | | Managing Director, Morehead Capital Management, LLC | | X | | | | • Audit • Finance and Risk Management • Regulatory Policy and Operations | | • None |

| | | | | | | | | | | | | | | |

William E. Kennard | | 58 | | 2014 | | Non-Executive Chairman, Velocitas Partners, LLC | | X | | | | • Corporate Governance • Finance and Risk Management • Regulatory Policy and Operations | | • AT&T Inc. • Ford Motor Company • MetLife, Inc. |

| | | | | | | | | | | | | | | |

E. Marie McKee | | 64 | | 2012 | | Retired Senior Vice President, Corning Incorporated | | X | | | | • Audit • Compensation • Corporate Governance | | • None |

| | | | | | | | | | | | | | | |

Richard A. Meserve | | 70 | | 2015 | | President Emeritus, Carnegie Institution for Science | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | • Pacific Gas and Electric Company |

| | | | | | | | | | | | | | | |

James T. Rhodes | | 73 | | 2001 | | Retired Chairman, President and Chief Executive Officer, Institute of Nuclear Power Operations | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | • None |

| | | | | | | | | | | | | | | |

Carlos A. Saladrigas | | 66 | | 2012 | | Chairman, Regis HR Group, and Chairman, Concordia Healthcare Holdings, LLC | | X | | | | • Audit • Compensation • Regulatory Policy and Operations | | • Advance Auto Parts, Inc. |

| | | | | | | | | | | | | | | |

| 6 DUKE ENERGY – 2015 Proxy Statement | | |

Even if you plan to attend this year's meeting, it is a good idea to vote your shares now, before the meeting, in the event your plans change. Whether you vote by Internet, by telephone or by mail, please have your proxy card or voting instruction form in hand and follow the instructions.

Table of Contents

Corporate Governance Highlights (page 27)

| | | | |

| | | | | |

By Internet using your computerü | |

By telephone | | By mailing your

proxy card |

|

|

|

|

|

Visit 24/7

www.proxyvote.com |

|

Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares are not registered in your name. |

|

Cast your ballot,

sign your proxy card

and send free of postage. |

|

DUKE ENERGY – 2014 Proxy Statement 3

Back to Contents

PARTICIPATE IN THE FUTURE OF DUKE ENERGY;

CAST YOUR VOTE RIGHT AWAY

Visit Our Website

| | |

Visit our website

http://www.duke-energy.com/investors/news-events.asp | | •

Review and download this proxy statement and our annual report

•

Listen to a live audio streamIndependent Chairman of the meeting

|

Attend Our 2014 Annual Shareholder Meeting

| | |

|

|

10:00 a.m. (EST) on Thursday, May 1, 2014

O.J. Miller Auditorium

526 South Church Street

Charlotte, NC 28202

Directions to 526 South Church Street are provided on the inside back cover.

526 South Church Street

Mint Street Parking Deck

Bank of America Stadium |

4 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

Table of Contents

DUKE ENERGY – 2014 Proxy Statement 5

Table of Contents

This proxy statement was first made available to shareholders on or about March 20, 2014.

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. Page references ("XX") are supplied to help you find further information in this proxy statement.

Eligibility to Vote (page 11)

You can vote if you were a shareholder of record at the close of business on March 3, 2014.

How to Cast Your Vote (page 12)

You can vote by any of the following methods:

| | | | | | | | |

| | | | | | | | |

By Internet using your

computer

| | By telephone

| | By mailing your

proxy card

| | In person

| |

|

|---|

|

|

|

|

|

|

|

|

|

Visit 24/7

www.proxyvote.com | |

Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares are not registered in your name. | |

Cast your ballot, sign

your proxy card and

send free of postage. | | At the annual shareholder meeting: If you are a shareholder of record, you may be admitted to the meeting by bringing your notice, proxy card or, if your shares are held in the name of a broker, bank or other nominee, an account statement or letter from the nominee indicating your ownership as of the record date, along with some form of government-issued identification.Board | | |

| | | | | |

| ü | | | | | | Annual election of directors | | |

| | | | | |

| ü | | Majority voting for directors, with mandatory resignation policy and plurality carve-out for contested elections | | |

| | | | | |

| ü | | Substantial majority of independent directors (15 out of 16) | | |

| | | | | |

| ü | | Annual Board, Committee and Director Assessments | | |

| | | | | |

| ü | | Independent Board committees | | |

| | | | | |

| ü | | No poison pill | | |

| | | | | |

| ü | | Board oversight of risk | | |

| | | | | |

| ü | | Ability for shareholders to take action by less than unanimous written consent | | 2014 Corporate Governance Enhancement |

| | | | | |

| ü | | Ability for shareholders to call a special shareholder meeting | | 2014 Corporate Governance Enhancement |

| | | | | |

| ü | | Shareholder engagement program | | 2014 Corporate Governance Enhancement |

| | | | | |

| ü | | Robust governance of political activities | | 2014 Corporate Governance Enhancement |

| | | | | |

Business Highlights Shareholder Engagement

As part of Duke Energy's regulated utility operations provide electricitycommitment to 7.2 million customers located in six states incorporate governance, we have instituted a corporate governance engagement program to discuss our corporate governance practices and obtain feedback from our shareholders on our corporate governance and executive compensation practices. During the Southeast and Midwest United States, representing a populationFall 2014 corporate governance engagement program, the Company met with the holders of approximately 22 million people. Our nonregulated businesses own25% of our shares to discuss, among other issues, board structure and operate diverse power generation assets in North America and Latin America, including a growing portfolio of renewable energy assets in the United States. Duke Energy operates in the United States, primarily through its direct and indirect wholly owned subsidiaries, Duke Energy Carolinas, LLC; Duke Energy Progress, Inc.; Duke Energy Florida, Inc.; Duke Energy Ohio, Inc.; Duke Energy Kentucky, Inc.; and Duke Energy Indiana, Inc.,director refreshment, as well as in Latin America through Duke Energy International, LLC.

Governancethe shareholder proposals which were voted on at the 2014 Annual Meeting of Shareholders, including the Company (page 21)

•Board Leadership Structure

•Meeting Attendance

•Risk Oversight

•Director Independence

•Committeesright for shareholders to call a special shareholder meeting, and Attendance

•Director Qualification Standards

•Criteria for Board Membership

•Majority Vote Standard

•Communications with Directors

political contribution disclosure.

6 DUKE ENERGY – 2014 Proxy Statement

| | | DUKE ENERGY – 2015 Proxy Statement 7 |

Table of Contents

Executive Compensation Highlights (page 37)

Board Nominees Named Executive Officers (page 15)37)

| | | | | | | | | | | | | | | | |

| |

| |

| |

| | Independent (Yes/No) | |

| |

|

|---|

| |

| | Director

since

| |

| | Committee

Memberships

| | Other Public

Company Boards

|

|---|

Name

| | Age

| | Occupation

| | Yes

| | No

|

|---|

| |

|---|

G. Alex Bernhardt, Sr. | | | 70 | | | 1991 | | Chairman, Bernhardt Furniture Company | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

Michael G. Browning | | | 67 | | | 1990 | | Chairman, Browning Investments, Inc. | | X | | | | • Audit • Corporate Governance • Finance and Risk Management | | None |

| |

Harris E. DeLoach, Jr. | | | 69 | | | 2006 | | Executive Chairman, Sonoco Products Company | | X | | | | • Corporate Governance • Nuclear Oversight | | • Sonoco Products Company • Goodrich Corporation |

| |

Daniel R. DiMicco | | | 63 | | | 2007 | | Retired Chairman, President and Chief Executive Officer, Nucor Corporation | | X | | | | • Corporate Governance • Nuclear Oversight | | None |

| |

John H. Forsgren | | | 67 | | | 2009 | | Retired Vice Chairman, Executive Vice President and Chief Financial Officer, Northeast Utilities | | X | | | | • Finance and Risk Management • Nuclear Oversight | | • The Phoenix Companies, Inc. |

| |

Lynn J. Good

Vice Chairman | | | 54 | | | 2013 | | Vice Chairman, President and Chief Executive Officer, Duke Energy Corporation | | | | X | | None | | • Hubbell Incorporated |

| |

Ann M. Gray

Chairman of the Board | | | 68 | | | 1994 | | Former Vice President, ABC, Inc. and former President, Diversified Publishing Group, ABC, Inc. | | X | | | | • Compensation • Corporate Governance • Finance and Risk Management | | • The Phoenix Companies, Inc. |

| |

James H. Hance, Jr. | | | 69 | | | 2005 | | Retired Vice Chairman and Chief Financial Officer, Bank of America Corporation | | X | | | | • Audit • Compensation • Finance and Risk Management | | • Cousins Properties Incorporated • Ford Motor Company • The Carlyle Group, LP |

| |

John T. Herron | | | 60 | | | 2013 | | Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

James B. Hyler, Jr. | | | 66 | | | 2008 | | Managing Director, Investors Management Corporation | | X | | | | • Audit • Finance and Risk Management • Regulatory Policy and Operations | | None |

| |

William E. Kennard | | | 57 | | | 2014 | | Senior Advisor, Grain Management | | X | | | | • Finance and Risk Management | | • MetLife, Inc. |

| |

E. Marie McKee | | | 63 | | | 1999 | | President, Corning Museum of Glass | | X | | | | • Audit • Compensation • Corporate Governance | | None |

| |

E. James Reinsch | | | 70 | | | 2009 | | Retired Senior Vice President and Partner, Bechtel Group and past President, Bechtel Nuclear | | X | | | | • Finance and Risk Management • Nuclear Oversight | | None |

| |

James T. Rhodes | | | 72 | | | 2001 | | Retired Chairman, President and Chief Executive Officer, Institute of Nuclear Power Operations | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

Carlos A. Saladrigas | | | 65 | | | 2001 | | Chairman, Regis HR Group, Concordia Healthcare Holdings, LLC | | X | | | | • Audit • Compensation • Regulatory Policy and Operations | | • Advance Auto Parts, Inc. |

| |

| | | | | | | | |

Name

| | Age

| | Occupation

| | Since

| | Previous occupation

|

|---|

| | | | | | | | | |

| Lynn J. Good | | 55 | | Vice Chairman, President and Chief Executive Officer | | 2013 | | Executive Vice President and Chief Financial Officer from July 2009 through June 2013 |

| | | | | | | | | |

| Steven K. Young | | 56 | | Executive Vice President and Chief Financial Officer | | 2013 | | Vice President, Chief Accounting Officer and Controller of Duke Energy from July 2012 until August 2013; Senior Vice President, Chief Accounting Officer and Controller of Duke Energy from December 2006 until July 2012 |

| | | | | | | | | |

| Dhiaa M. Jamil | | 58 | | Executive Vice President and President, Regulated Generation | | 2014 | | Executive Vice President and President, Duke Energy Nuclear from March 2013 through August 2014; Chief Nuclear Officer of Duke Energy from 2008 until March 2013; Chief Generation Officer of Duke Energy from July 2009 until March 2013 |

| | | | | | | | | |

| Marc E. Manly | | 63 | | Executive Vice President and President, Commercial Portfolio | | 2014 | | Executive Vice President and President, Commercial Businesses from December 2012 through August 2014; Chief Legal Officer of Duke Energy from April 2006 until December 2012 |

| | | | | | | | | |

| Lloyd M. Yates | | 54 | | Executive Vice President, Market Solutions and President, Carolinas Region | | 2014 | | Executive Vice President, Regulated Utilities from December 2012 through August 2014; Executive Vice President, Customer Operations of Duke Energy from July 2012 until December 2012; President and Chief Executive Officer of Duke Energy Progress, Inc. from July 2007 until June 2012 |

| | | | | | | | | |

DUKE ENERGY – 2014 Proxy Statement 7

Table of Contents

Named Executive Officers (page 36)

| | | | | | | | | | |

Name

| | Age

| | Occupation

| | Since

| | Previous occupation

|

|---|

| |

|---|

Lynn J. Good | | | 54 | | Vice Chairman, President and Chief Executive Officer | | | 2013 | | Chief Financial Officer of Duke Energy from July 2009 through June 2013; President, Commercial Businesses of Duke Energy from November 2007 through June 2009 |

| |

Steven K. Young | | | 55 | | Executive Vice President and Chief Financial Officer | | | 2013 | | Vice President, Chief Accounting Officer and Controller of Duke Energy from July 2012 until August 2013; Senior Vice President and Controller of Duke Energy from December 2006 until July 2012 |

| |

Marc E. Manly | | | 62 | | Executive Vice President and President, Commercial Businesses | | | 2012 | | Chief Legal Officer of Duke Energy from April 2006 until December 2012 |

| |

Dhiaa M. Jamil | | | 57 | | Executive Vice President and President, Duke Energy Nuclear | | | 2013 | | Chief Nuclear Officer of Duke Energy from 2008 until March 2013; Chief Generation Officer of Duke Energy from July 2009 until March 2013; Senior Vice President, Nuclear Support of Duke Energy Carolinas, LLC from January 2007 to February 2008 |

| |

Lloyd M. Yates | | | 53 | | Executive Vice President, Regulated Utilities | | | 2012 | | Executive Vice President, Customer Operations of Duke Energy from July 2012 until December 2012; President and Chief Executive Officer of Duke Energy Progress, Inc. from July 2007 until June 2012 |

| |

*Other Named Executive Officers include James E. Rogers, President and Chief Executive Officer of Duke Energy until June 30, 2013, and Chairman of the Board until his retirement on December 31, 2013.

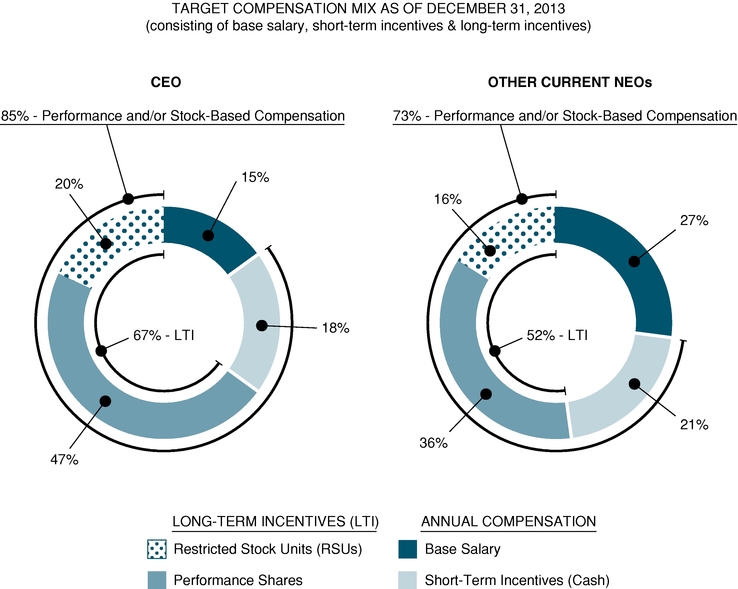

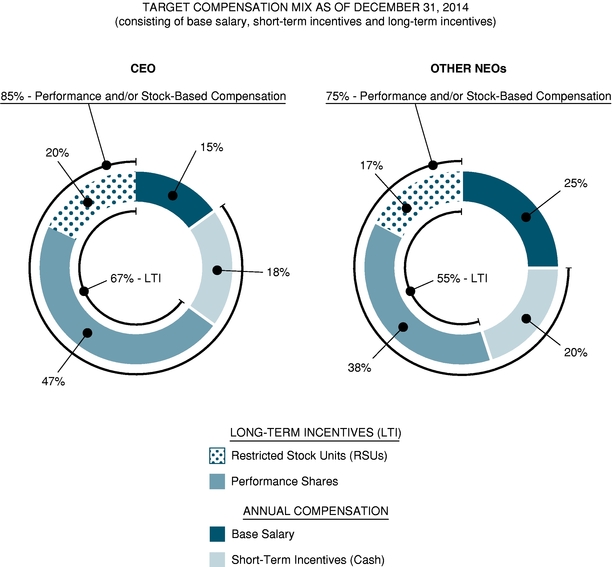

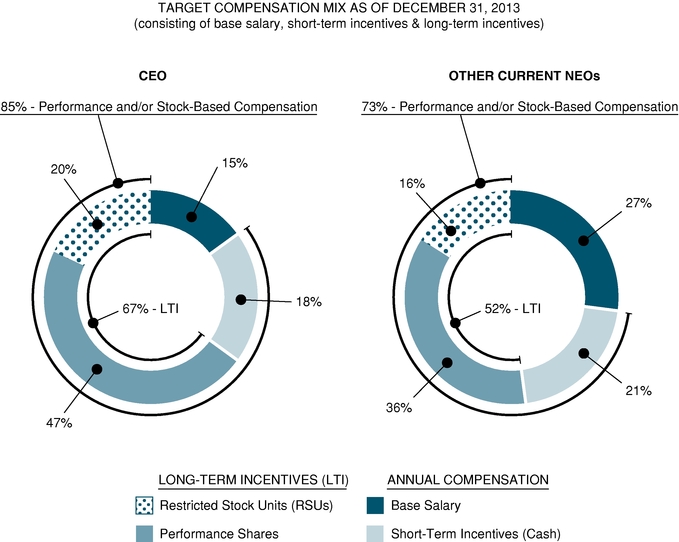

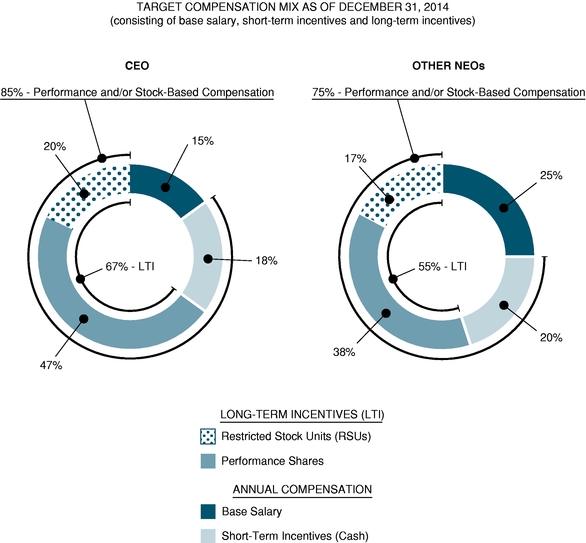

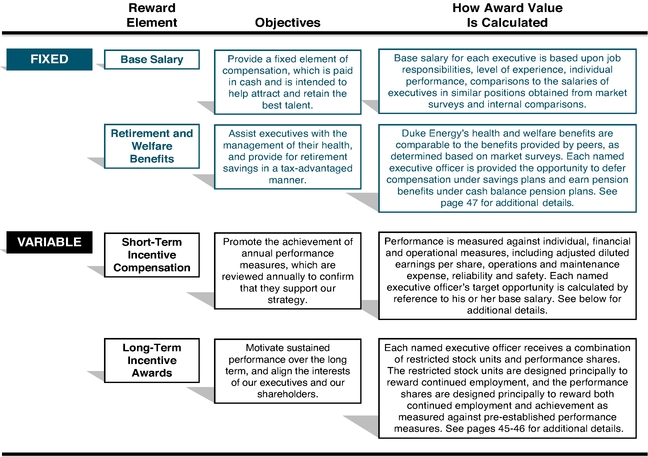

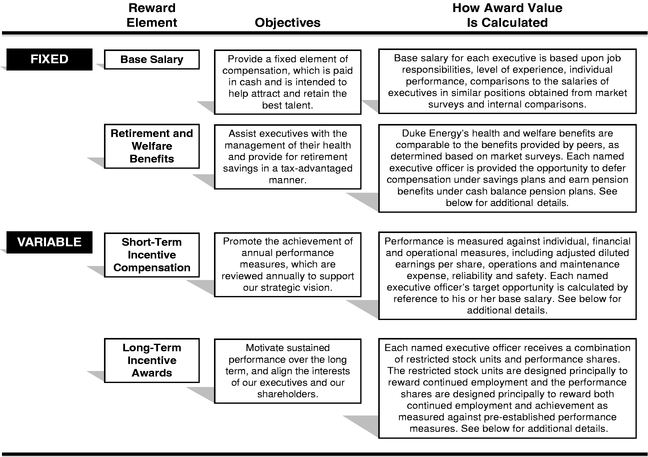

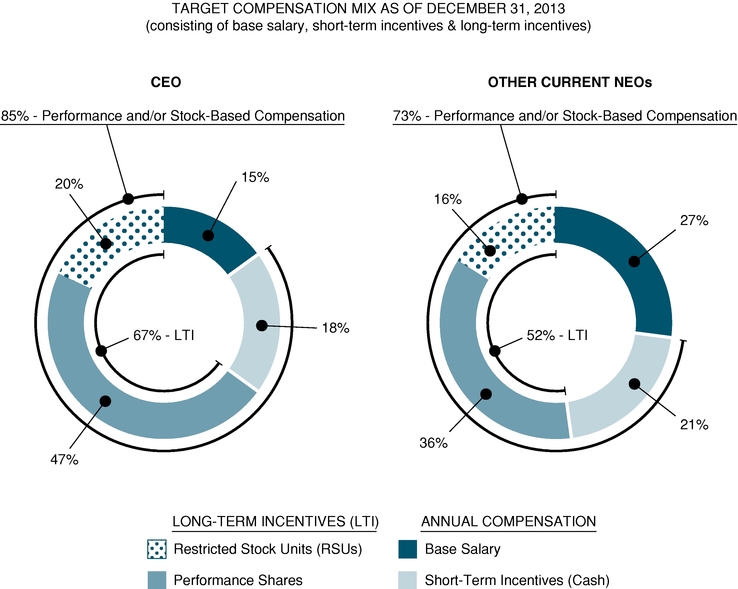

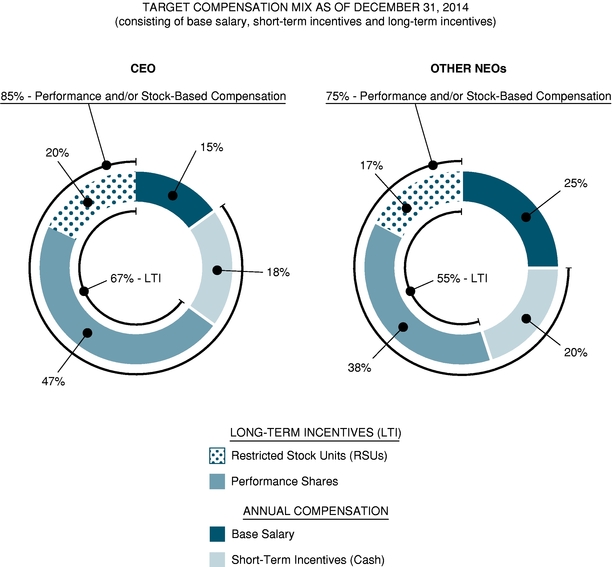

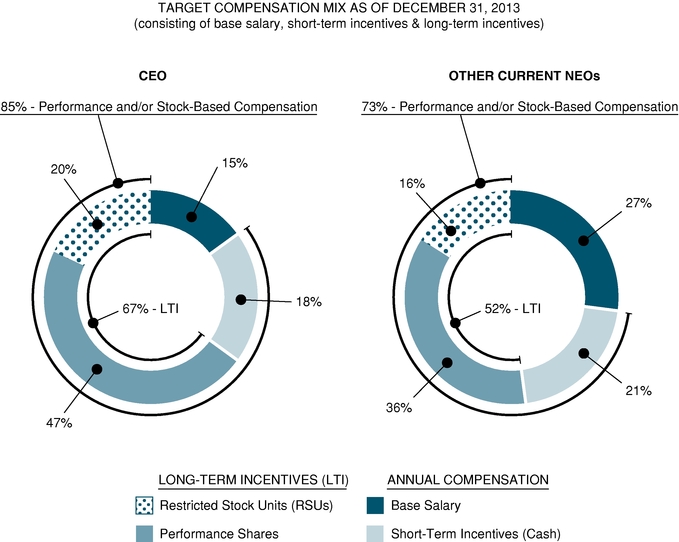

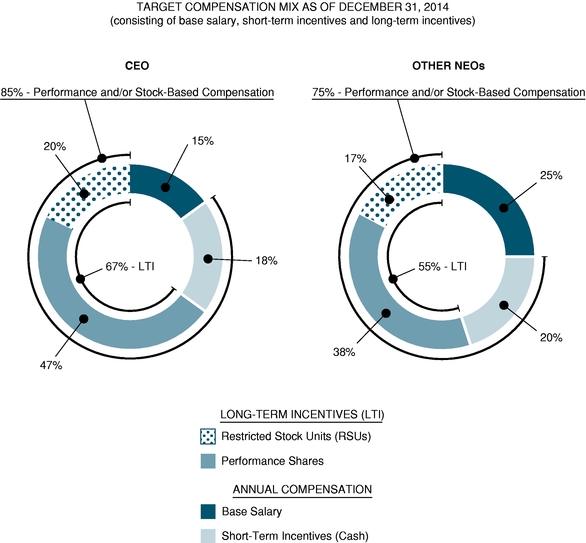

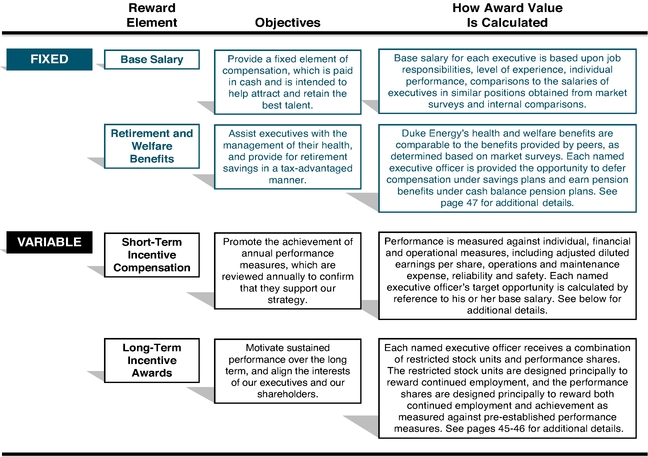

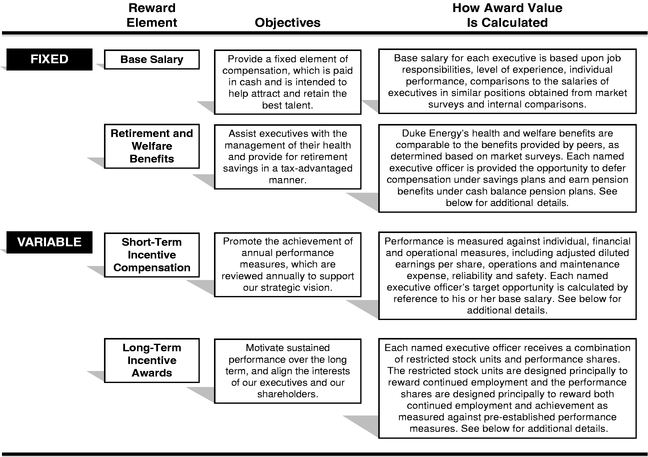

Executive Compensation (page 36)

Principles and Objectives (page 36)37)

Our executive compensation program is designed to:

- •

- Link pay to performance

- •

- Attract and retain talented executive officers and key employees

- •

- Emphasize performance-based compensation to motivate executives and key employees

- •

- Reward individual performance

- •

- Encourage long-term commitment to Duke Energy and align the interests of executives with shareholders

We meet these objectives through the appropriate mix of compensation, including:

- •

- Base salary

- •

- Short-term incentives

- •

- Long-term incentives

8 DUKE ENERGY – 2014 Proxy Statement

| 8 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

2013 2014 Executive Total Compensation Mix (page 37)38)

Independent Public Accountant (page 33)

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of Deloitte & Touche LLP as our independent public accountant for 2014.

Voting Matters (page 11)

| | | | | | | | |

| | Board Vote

Recommendation

| | Page Reference

(for more detail)

| |

|---|

| |

|---|

Management Proposals | | | | | | | |

| |

Election of Directors | | | FORDUKE ENERGY each nominee– | | | 15 | |

| |

Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 2014 | | | FOR2015 Proxy Statement | | | 33 | |

| |

Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation | | | FOR9 | | | 35 | |

| |

Amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent | | | FOR | | | 68 | |

| |

Shareholder Proposals | | | | | | | |

| |

Shareholder proposal regarding shareholder right to call a special shareholder meeting | | | AGAINST | | | 69 | |

| |

Shareholder proposal regarding political contribution disclosure | | | AGAINST | | | 71 | |

| |

DUKE ENERGY – 2014 Proxy Statement 9

Table of Contents

| | |

|

|

Notice of Annual ShareholderMeeting

Meetingof Shareholders

|

|

|

|

May 1, 20147, 2015

10:00 a.m.

O.J. Miller Auditorium

526 South Church Street

Charlotte, North CarolinaNC 28202

We will convene the annual shareholder meetingAnnual Meeting of Shareholders of Duke Energy Corporation on Thursday, May 1, 2014,7, 2015, at 10:00 a.m. in the O.J. Miller Auditorium located at 526 South Church Street in Charlotte, North Carolina.

The purpose of the annual meetingAnnual Meeting is to consider and take action on the following:

- 1.

- Election of directors;

- 2.

- Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for

2014;2015;

- 3.

Approval, on an advisory basis, ofAdvisory vote to approve Duke Energy Corporation's named executive officer compensation;

- 4.

Amendment toApproval of the Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent;Corporation 2015 Long-Term Incentive Plan;

- 5.

- A shareholder proposal regarding

shareholder right to call a special shareholder meeting;limitation of accelerated executive pay;

- 6.

- A shareholder proposal regarding political contribution disclosure;

and

- 7.

- A shareholder proposal regarding proxy access; and

- 8.

- Any other business that may properly come before the meeting (or any adjournment or postponement of the meeting).

Shareholders of record as of the close of business on March 3, 2014,9, 2015, are entitled to vote at the annual shareholder meeting.Annual Meeting of Shareholders. It is important that your shares are represented at this meeting.

This year we will again be using the Securities and Exchange Commission ("SEC") rule that allows us to provide our proxy materials to our shareholders via the Internet. By doing so, most of our shareholders will only receive a notice containing instructions on how to access the proxy materials via the Internet and vote online, by telephone or by mail. If you would like to request paper copies of the proxy materials, you may follow the instructions on the notice. If you receive paper copies of the proxy materials, we ask you to consider signing up to receive these materials electronically in the future by following the instructions contained in this proxy statement. By delivering proxy materials electronically, we can reduce the consumption of natural resources and the cost of printing and mailing our proxy materials.

Whether or not you expect to be present at the annual shareholder meeting,Annual Meeting of Shareholders, please take time to vote now. If you choose to vote by mail, you may do so by marking, dating and signing the proxy card and returning it to us. Please follow the voting instructions that are included on your proxy card. Regardless of the manner in which you vote, we urge and greatly appreciate your prompt response.

| | |

Dated: March 20, 201426, 2015 | | By order of the Board of Directors, |

|

|

|

| | JulieJulia S. Janson

Executive Vice President, Chief Legal Officer and Corporate Secretary |

10 DUKE ENERGY – 2014 Proxy Statement

| 10 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

On what am I voting?

| | | | | | | | | | | | |

| |

| | More

information

| | Board

recommendation

| | Broker non-votes

| | Abstentions

| | Votes

required

for approval

|

|---|

|

|---|

PROPOSAL 1 |

|

Election of directors |

|

Page 15 |

|

FOR each

nominee |

|

Do not count |

|

Do not count |

|

Majority of votes cast, with a resignation policy |

|

PROPOSAL 2 |

|

Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 2014 |

|

Page 33 |

|

FOR |

|

Vote for |

|

Vote against |

|

Majority of

shares

represented |

|

PROPOSAL 3 |

|

Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation |

|

Page 35 |

|

FOR |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

PROPOSAL 4 |

|

Amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent |

|

Page 68 |

|

FOR |

|

Vote against |

|

Vote against |

|

Majority of

outstanding shares

entitled to vote |

|

PROPOSAL 5 |

|

Shareholder proposal regarding shareholder right to call a special shareholder meeting |

|

Page 69 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

PROPOSAL 6 |

|

Shareholder proposal regarding political contribution disclosure |

|

Page 71 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

Who can vote?

Holders of Duke Energy's common stock as of the close of business on the record date, March 3, 2014, are entitled to vote, either in person or by proxy, at the annual shareholder meeting. Each share of Duke Energy common stock has one vote.

DUKE ENERGY – 2014 Proxy Statement 11

Back to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

How do I vote?

By Proxy – Before the annual shareholder meeting, you can give a proxy to vote your shares of Duke Energy common stock in one of the following ways:

| | | | | |

| | | | | |

| | | | | |

| By Internet using your computer

| | By telephone

| | By mailing your proxy card

|

|---|

|

| |

| |

|

|

Visit 24/7

www.proxyvote.com |

|

Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares

are not registered in your name. |

|

Cast your ballot,

sign your proxy card

and send free of postage. |

| | | | | |

The telephone and Internet voting procedures are designed to confirm your identity, to allow you to give your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by telephone or Internet, please follow the instructions that are included on your notice.

If you mail us your properly completed and signed proxy card or vote by telephone or Internet, your shares of Duke Energy common stock will be voted according to the choices that you specify. If you sign and mail your proxy card without marking any choices, your proxy will be voted:

•FOR the election of all nominees for director;

•FOR the ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014;

•FOR the approval, on an advisory basis, of Duke Energy's named executive officer compensation;

•FOR the approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent;

•AGAINST the shareholder proposal regarding shareholder right to call a special shareholder meeting; and

•AGAINST the shareholder proposal regarding political contribution disclosure.

We do not expect that any other matters will be brought before the annual shareholder meeting. However, by giving your proxy, you appoint the persons named as proxies as your representatives at the annual shareholder meeting.

In Person – You may come to the annual shareholder meeting and cast your vote there. You may be admitted to the meeting by bringing your notice, proxy card or, if your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on March 3, 2014, along with some form of government-issued identification.

May I change or revoke my vote?

Yes. You may change your vote or revoke your proxy at any time prior to the annual shareholder meeting by:

•notifying Duke Energy's Corporate Secretary in writing that you are revoking your proxy;

•providing another signed proxy that is dated after the proxy you wish to revoke;

•using the telephone or Internet voting procedures; or

•attending the annual shareholder meeting and voting in person.

Will my shares be voted if I do not provide my proxy?

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at the meeting.

Brokerage firms generally have the authority to vote their customers' unvoted shares on certain "routine" matters. If your shares are held in the name of a broker, bank or other nominee, such nominee can vote your shares for the ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014 if you do not timely provide your proxy because this matter is considered "routine" under the applicable rules. However, no other items are considered "routine" and may not be voted by your broker without your instruction.

12 DUKE ENERGY – 2014 Proxy Statement

Back to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

If I am a participant in the Duke Energy Retirement Savings Plan or the Savings Plan for Employees of Florida Progress Corporation, how do I vote shares held in my plan account?

If you are a participant in either of the plans listed above, you have the right to provide voting directions to the plan trustee, by submitting your proxy card, for those shares of Duke Energy common stock that are held by the plan and allocated to your account. Plan participant proxies are treated confidentially.

If you elect not to provide voting directions to the plan trustee, the plan trustee will vote the Duke Energy shares allocated to your plan account in the same proportion as those shares held by the plan for which the plan trustee has received voting directions from other plan participants. The plan trustee will follow participants' voting directions and the plan procedure for voting in the absence of voting directions, unless it determines that to do so would be contrary to the Employee Retirement Income Security Act of 1974.

The plan trustee for each of the respective plans is as follows:

•Duke Energy Retirement Savings Plan – Fidelity Management Trust Company

•Savings Plan for Employees of Florida Progress Corporation – Vanguard Fiduciary Trust Company

Because the plan trustee must process voting instructions from participants before the date of the annual shareholder meeting, you must deliver your instructions no later than April 28, 2014, at 11:59 p.m.

What constitutes a quorum?

As of the record date, 706,954,889 shares of Duke Energy common stock were issued and outstanding and entitled to vote at the annual shareholder meeting. In order to conduct the annual shareholder meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a "quorum." If you submit a properly executed proxy card or vote by telephone or on the Internet, you will be considered part of the quorum. Abstentions and broker "non-votes" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" is not, however, counted as present and entitled to vote for purposes of voting on individual proposals other than ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant. A broker "non-vote" occurs when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under NYSE listing standards, does not have discretionary authority to vote on a matter.

What vote is needed to approve the matters submitted?

•Election of directors. Directors are elected by a majority of the votes cast at the meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote for this proposal. If any nominee does not receive a majority of "FOR" votes, such nominee is required to submit his or her resignation for consideration by the Board of Directors.

•Ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have the same effect as votes for this proposal.

•Approval, on an advisory basis, of Duke Energy's named executive officer compensation. The affirmative vote of a majority of shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

•Approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent. The affirmative vote of a majority of outstanding shares entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have the same effect as votes against this proposal.

•Shareholder proposal regarding shareholder right to call a special shareholder meeting. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

•Shareholder proposal regarding political contribution disclosure. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

DUKE ENERGY – 2014 Proxy Statement 13

Back to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

Who conducts the proxy solicitation and how much will it cost?

Duke Energy is requesting your proxy for the annual shareholder meeting and will pay all the costs of requesting shareholder proxies. We have hired Georgeson Inc. to help us send out the proxy materials and request proxies. Georgeson's fee for these services is $21,000, plus out-of-pocket expenses. We can request proxies through the mail or personally by telephone, fax or Internet. We can use directors, officers and other employees of Duke Energy to request proxies. Directors, officers and other employees will not receive additional compensation for these services. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Duke Energy common stock.

14 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors of Duke Energy has nominated the following 1514 candidates to serve on the Board. We have a declassified Board of Directors, which means all of the directors are voted on every year at the annual shareholder meeting.Annual Meeting of Shareholders.

If any director is unable to stand for election, the Board of Directors may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve. The Corporate Governance Committee, comprised of only independent directors, has recommended the following current directors as nominees for director and the Board of Directors has approved their nomination for election. Two of our current directors, Messrs. BarnetBernhardt and Sharp,Reinsch, will be retiring at our 20142015 Annual Shareholder Meeting and thereforeof Shareholders in accordance with our Principles for Corporate Governance. Therefore, they are not nominated for re-election.

| | | DUKE ENERGY – 2015 Proxy Statement 11 |

DUKE ENERGY – 2014 Proxy Statement 15

Back toTable of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

Michael G. Alex Bernhardt, Sr.Browning

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 70: 68

Director of Duke Energy or its predecessor companies since 19912006

Chairman, Bernhardt Furniture CompanyBrowning Consolidated, LLC

| | Skills and Qualifications:Qualifications:• Mr. Bernhardt's qualifications for election include his management experience and his knowledge and understanding of industry in Duke Energy's North Carolina service territory.

| | Committees:•

Nuclear Oversight Committee

•

Regulatory Policy and Operations Committee

Other current public directorships:

•

None

|

Mr. Bernhardt has been associated with Bernhardt Furniture Company, a furniture manufacturer, since 1965. He has served as Chairman since 1996 and a director since 1976. Previously he served as President from 1976 until 1996 and CEO from 1996 until 2011. Mr. Bernhardt is a director of Communities In Schools and a trustee of the North Carolina Nature Conservancy. |

Michael G. Browning

|

Independent Director Nominee | | | | |

| | Age: 67

Director of Duke Energy or its predecessor companies since 1990

Chairman, Browning Investments, Inc.

| | Skills and Qualifications:•

Mr. Browning's qualifications for election include his management experience and his knowledge and understanding of Duke Energy's Midwest service territory. Mr. Browning's financial and investment backgroundexpertise adds a valuable perspective to the Board and its committees. | | Committees:Committees:• Audit Committee • Corporate Governance Committee • Finance and Risk Management Committee Other current public directorships:directorships: • None |

Mr. Browning has been Chairman of Browning Investments, Inc.Consolidated, LLC (and its predecessor), a real estate development firm, since 1981 and served as President from 1981 until 2013. He also serves as owner, general partner or managing member of various real estate entities. Mr. Browning is a former director of Standard Management Corporation, Conseco, Inc. and Indiana Financial Corporation. |

Harris E. DeLoach, Jr.

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 69: 70

Director of Duke Energy or its predecessor companies since 20062012

Executive Chairman,

Sonoco Products Company

| | Skills and Qualifications:Qualifications:• Mr. DeLoach's qualifications for election include his knowledge of the environmental regulations, particularly in Duke Energy's South Carolina service territory, as a result of his experience leading a public company with global manufacturing operations headquartered in South Carolina. His familiarity with the economic and business development issues facing the communities we serve his experience leadingis also extremely valuable to the Board and its committees. As a former practicing attorney and a board member of other public company with global operations and his understanding of Duke Energy's South Carolina service territory.privately held companies, he also brings in-depth legal and board governance experience. | | Committees:Committees:• Corporate Governance Committee • Nuclear Oversight Committee Other current public directorships:directorships: • Sonoco Products Company •

Goodrich Corporation

|

Mr. DeLoach has served as Executive Chairman of Sonoco Products Company, a manufacturer of paperboard and paper and plastic packaging products, since March 2013. He previously served as Chief Executive Officer of Sonoco Products Company from July 2000 to March 2013. Mr. DeLoach has been2013 and Chairman of the Sonoco Products Board of Directors sincefrom April 2005.2005 to March 2013. Prior to joining Sonoco Products in 1986, Mr. DeLoach was in a private law practice and served as an outside counsel to Sonoco Products for 15 years. |

16 DUKE ENERGY – 2014 Proxy Statement

| 12 DUKE ENERGY – 2015 Proxy Statement | | |

Back to

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

Daniel R. DiMicco

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 63: 64

Director of Duke Energy or its predecessor companies since 2007

Chairman Emeritus, Retired Chairman, President and Chief Executive Officer,

Nucor Corporation

| | Skills and Qualifications:Qualifications:• Mr. DiMicco's qualifications for election include his management experience, including Chief Executive Officer of a Fortune 500 company and successfully operating a company serving many constituencies. In addition, Mr. DiMicco's experience as Chief Executive Officer of a large industrial corporation provides a valuable perspective on Duke Energy's industrial customer class.class as well as extensive knowledge of the environmental regulations in Duke Energy's Carolinas and Midwest territories. | | Committees:Committees:• Corporate Governance Committee • Nuclear Oversight Committee Other current public directorships:directorships: • None |

Mr. DiMicco has served as Chairman Emeritus of Nucor Corporation, a steel company, since December 2013. From January 2013 until December 2013, Mr. DiMicco served as Executive Chairman of Nucor Corporation and as Chairman from May 2006 to December 2012, Chief Executive Officer from September 2000 to December 2012 and President from September 2000 to December 2010. He was a member of the Nucor Board of Directors from 2000 to 2013. Mr. DiMicco is a former chair of the American Iron and Steel Institute. |

John H. Forsgren

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 67: 68

Director of Duke Energy or its predecessor companies since 2009

Retired Vice Chairman, Executive Vice President and Chief Financial Officer, Northeast Utilities

| | Skills and Qualifications:Qualifications:• Mr. Forsgren's qualifications for election include his prior management and financial experience asAs a former Vice Chairman and Chief Financial Officer of a large utility company, Mr. Forsgren's qualifications for election include financial and hisrisk management expertise as well as extensive knowledge of the energy industry, the regulatory environment within the industry and insight on renewable energy.

| | Committees:Committees:• Finance and Risk Management Committee • Nuclear Oversight Committee Other current public directorships:directorships: • The Phoenix Companies, Inc. |

Mr. Forsgren has been Chairman of The Phoenix Companies, Inc. since 2013 and was Vice Chairman, Executive Vice President and Chief Financial Officer of Northeast Utilities from 1996 until his retirement in 2004. He is a former director of CuraGen Corporation and Neon Communications Group, Inc. |

| | DUKE ENERGY – 2015 Proxy Statement 13 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

Lynn J. Good

|

| | | | | | | |

Non-Independent Director Nominee

Vice Chairman of the Board |

| | | |

| | Age:Age 54: 55

Director of Duke Energy or its predecessor companies since 2013

Vice Chairman, President and Chief Executive Officer, Duke Energy Corporation

| | Skills and Qualifications:Qualifications:• Ms. Good's qualifications for election include her experience asGood is our Chief Executive Officer and was previously our Chief Financial Officer of Duke Energy, herOfficer. Her knowledge of the affairs of Duke Energy and its businesses,business and her experience in the energy industry.industry provide valuable resources for the Board. | | Committees:Committees:• None Other current public directorships:directorships: • Hubbell Incorporated |

Ms. Good has served as Vice Chairman, President, Chief Executive Officer and a member of the Board of Directors of Duke Energy since July 2013. She served as Executive Vice President and Chief Financial Officer of Duke Energy from July 2009 through June 2013. Prior to that she served as President, Commercial Businesses from November 2007 through June 2009. |

DUKE ENERGY – 2014 Proxy Statement 17

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

Ann M.Maynard Gray

|

| | | | | | | |

Independent Director Nominee

Chairman of the Board |

| | | |

| | Age:Age 68: 69

Director of Duke Energy or its predecessor companies since 19941997

FormerRetired Vice President, ABC, Inc. and former President, Diversified Publishing Group, ABC, Inc.

| | Skills and Qualifications:Qualifications:• Ms. Gray's qualifications for election include her business experience, both from a management perspective and as a result of her experience as a director at several public companies. Ms. Gray's public company experience has also given her in-depth knowledge of governance principles, which she utilizes on a variety of matters, including, among other things, succession planning, executive compensation and corporate governance. | | Committees:Committees:• Compensation Committee • Corporate Governance Committee • Finance and Risk Management Committee Other current public directorships:directorships: • The Phoenix Companies, Inc. |

Ms. Gray was President of Diversified Publishing Group of ABC, Inc., a television, radio and publishing company, from 1991 until 1997 and was a Corporate Vice President of ABC, Inc. and its predecessors from 1979 to 1998. Ms. Gray is a former director of Elan Corporation, plc and former trustee of JPMorgan Funds. |

14 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

James H. Hance, Jr.

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 69: 70

Director of Duke Energy or its predecessor companies since 2005

Retired Vice Chairman and Chief Financial Officer, Bank of America Corporation

| | Skills and Qualifications:Qualifications:• Mr. Hance's qualifications for election include his management and financial experience as Vice Chairman and Chief Financial Officer of one of our nation's largest financial institutions, his broad background as a director of a number of large financial and industrial corporations, and his expertise in finance.finance and risk management. | | Committees:Committees:• Audit Committee • Compensation Committee • Finance and Risk Management Committee Other current public directorships:directorships: • Acuity Brands, Inc. • Cousins Properties Incorporated • Ford Motor Company • The Carlyle Group, LP |

Mr. Hance was Vice Chairman of Bank of America from 19941993 until his retirement in 2005 and served as Chief Financial Officer from 1988 to 2004. Since retiring in 2005, Mr. Hance has served as a director for various public companies. He is a certified public accountant and spent 17 years with Price Waterhouse (now PricewaterhouseCoopers LLP). He is a former director of Bank of America, Rayonier Inc., Morgan Stanley, and EnPro Industries, Inc. and Sprint-Nextel Corporation. Mr. Hance also serves as an operating executive of The Carlyle Group, LP and is a member of its board of directors. |

John T. Herron

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 60: 61

Director of Duke Energy or its predecessor companies since 2013

Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear

| | Skills and Qualifications:Qualifications:• Mr. Herron's qualifications for election include his knowledge and extensive insight gained atas a variety of nuclear energy facilities over more thansenior executive in the utility industry, including his three decades as well as his previous managementof experience in nuclear energy. During Mr. Herron's career, he has gained significant regulatory and risk management expertise, which is an asset to the energy industry.Board and its committees. | | Committees:Committees:• Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships:directorships: • None |

Mr. Herron was President, Chief Executive Officer and Chief Nuclear Officer of Entergy Nuclear from 2009 until his retirement on March 31,in 2013. Mr. Herron joined Entergy Nuclear in 2001 and held a variety of positions. He began his career in nuclear operations in 1979 and has held positions at a number of nuclear stations across the country. Mr. Herron is a director of Ontario Power Generation and also has served on the Institute of Nuclear Power Operations' board of directors. |

18 DUKE ENERGY – 2014 Proxy Statement

| | | DUKE ENERGY – 2015 Proxy Statement 15 |

Back to

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

James B. Hyler, Jr.

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 66: 67

Director of Duke Energy or its predecessor companies since 20082012

Managing Director, InvestorsMorehead Capital Management, CorporationLLC

| | Skills and Qualifications:Qualifications:• Mr. Hyler's qualifications for election include his understanding of Duke Energy's North Carolina service territory and his knowledge and expertise in financial services, corporate finance and corporate finance.risk management. | | Committees:Committees:• Audit Committee • Finance and Risk Management Committee • Regulatory Policy and Operations Committee Other current public directorships:directorships: • None |

Mr. Hyler is Managing Director of InvestorsMorehead Capital Management, Corporation,LLC, a firm which invests in and acquires companies in various industries, since December 2011. He retired as Vice Chairman and Chief Operating Officer of First Citizens Bank in 2008, having served in these positions from 1994 until 2008. Mr. Hyler was President of First Citizens Bank from 1988 to 1994 and was Chief Financial Officer of First Citizens Bank from 1980 to 1988. Prior to joining First Citizens Bank, Mr. Hyler was an auditor with Ernst & Young for 10 years. Mr. Hyler served as a director of First Citizens BancShares from 1988 until 2008. |

William E. Kennard

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 57: 58

Director of Duke Energy or its predecessor companies since 2014

Senior Advisor, Grain ManagementNon-Executive Chairman, Velocitas Partners, LLC

| | Skills and Qualifications:Qualifications:• Mr. Kennard's qualifications for election include his considerable experience and knowledge of the regulatory arena, as well as his financial knowledge, legal knowledge and international perspective. As former Chairman of the Federal Communications Commission, Mr. Kennard also has a great deal of expertise in technology, which is extremely valuable to the Board and its committees. | | Committees:Committees:• Corporate Governance Committee • Finance and Risk Management Committee • Regulatory Policy and Operations Committee Other current public directorships:directorships: • AT&T Inc. • Ford Motor Company • MetLife, Inc. |

Mr. Kennard is Non-Executive Chairman of Velocitas Partners, LLC, an asset management and advisory firm, since November 2014, as well as a member of the Operating Executive Committee of Staple Street Capital, a private equity firm. Prior to joining Velocitas Partners, LLC, Mr. Kennard served as Senior Advisor at Grain Management a private equity firm, sincefrom October 2013. Prior2013 to joining Grain Management, Mr. Kennard served asNovember 2014; U.S. Ambassador to the European Union from 2009 to August 2013; Managing Director of The Carlyle Group from 2001 to 2009; and Chairman of the Federal Communications Commission from 1997 to 2001. Mr. Kennard holds a law degree from Yale Law School. |

| 16 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

E. Marie McKee

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 63: 64

Director of Duke Energy or its predecessor companies since 19992012

Retired Senior Vice President, Corning Museum of GlassIncorporated

| | Skills and Qualifications:Qualifications:• Ms. McKee's qualifications for election include her experience in human resources, which provides her with a thorough knowledge of employment and compensation practices. Her prior experience as Presidenta senior executive of Steuben GlassCorning Incorporated has also given her excellent operating skills and an understanding of financial matters. | | Committees:Committees:• Audit Committee • Compensation Committee • Corporate Governance Committee Other current public directorships:directorships: • None |

Ms. McKee is President of the Corning Museum of Glass since 1998, and she served asa retired Senior Vice President of Human Resources at Corning Incorporated, a manufacturer of components for high-technology systems for consumer electronics, mobile emissions controls, telecommunications and life sciences, from 1996 to 2010.sciences. Ms. McKee has over 3035 years of experience at Corning, where she held a variety of management positions with increasing levels of responsibility, including Senior Vice President of Human Resources from 1996 to 2010; President of Steuben Glass.Glass; and President of The Corning Museum of Glass and The Corning Foundation from 1998 to 2014. |

Richard A. Meserve     |

| | | | | | | |

| Independent Director Nominee |

| | Age: 70

Director of Duke Energy since 2015

President Emeritus, Carnegie Institution for Science | | Skills and Qualifications: • Dr. Meserve's qualifications for election include technical, legal, regulatory and public policy expertise in numerous areas, including nuclear power, energy policy, environmental and climate change, as well as leadership and business skills developed as an executive and a director of, and an advisor to, national and international scientific, research and legal organizations. | | Committees: • Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships: • Pacific Gas and Electric Company |

Dr. Meserve is President Emeritus of the Carnegie Institution for Science and has held that position since April 2003. He has served on a part-time basis as Senior of Counsel to the international law firm of Covington & Burling LLP since April 2004. Prior to joining the Carnegie Institution for Science, Dr. Meserve was Chairman of the U.S. Nuclear Regulatory Commission. He also served as a partner at the law firm of Covington & Burling LLP. He previously served as a member of the Blue Ribbon Commission on America's Nuclear Future (chartered by the Secretary of Energy) from 2010 to 2012, as legal counsel to President Carter's science and technology advisor, and as a law clerk to Justice Harry A. Blackmun of the U.S. Supreme Court. Dr. Meserve is Chairman of the International Nuclear Safety Group, which is chartered by the International Atomic Energy Agency. He currently is co-chairman of the U.S. Department of Energy's Nuclear Energy Advisory Committee and a member of the Secretary of Energy Advisory Board. |

DUKE ENERGY – 2014 Proxy Statement 19

| | | DUKE ENERGY – 2015 Proxy Statement 17 |

Back to

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

E. James ReinschT. Rhodes

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 70: 73

Director of Duke Energy or its predecessor companies since 20092001

Retired Senior Vice President and Partner, Bechtel Group and past President, Bechtel Nuclear

| | Skills and Qualifications:•

Mr. Reinsch's qualifications for election include his management experience and extensive knowledge of the nuclear industry and construction business.

| | Committees:•

Finance and Risk Management Committee

•

Nuclear Oversight Committee

Other current public directorships:

•

None

|

Mr. Reinsch was Senior Vice President and Partner of Bechtel Group from 2003 to 2008 and past president of Bechtel Nuclear from 2000 until his retirement in 2009. He has served on the boards of several international nuclear energy organizations, including the International Nuclear Energy Academy. He has also served on the U.S. Department of Energy's Hydrogen and Fuel Cell Technical Advisory Committee. |

James T. Rhodes

|

Independent Director Nominee | | | | |

| | Age: 72

Director of Duke Energy or its predecessor companies since 2001

Retired Chairman, President and Chief Executive Officer, Institute of Nuclear Power Operations

| | Skills and Qualifications:Qualifications:• Dr. Rhodes' qualifications for election include his management experience as Chief Executive Officer of a large non-profit organization in the energy industry, as well as his in-depth knowledge of the energy and nuclear industry.industry and expertise in risk management. | | Committees:Committees:• Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships:directorships: • None |

Dr. Rhodes was Chairman and Chief Executive Officer of the Institute of Nuclear Power Operations, a nonprofitnon-profit corporation promoting safety, reliability and excellence in nuclear plant operation, from 1998 to 1999 and Chairman, President and Chief Executive Officer from 1999 until his retirement in 2001. He served as President and Chief Executive Officer of Virginia Electric & Power Company, a subsidiary of Dominion Resources, Inc., from 1989 until 1997. Dr. Rhodes is a former member of the Advisory Council for the Electric Power Research Institute. |

Carlos A. Saladrigas

|

| | | | | | | |

| Independent Director Nominee |

| | | |

| | Age:Age 65: 66

Director of Duke Energy or its predecessor companies since 20012012

Chairman, Regis HR Group, and Chairman, Concordia Healthcare Holdings, LLC

| | Skills and Qualifications:Qualifications:• Mr. Saladrigas' qualifications for election include his extensive expertise in the human resources, financial services and accounting arenas, as well as his understanding of Duke Energy's Florida service territory. | | Committees:Committees:• Audit Committee • Compensation Committee • Regulatory Policy and Operations Committee Other current public directorships:directorships: • Advance Auto Parts, Inc. |

Mr. Saladrigas is Chairman of Regis HR Group, which offers a full suite of outsourced human resources services to small and mid-sized businesses. He has served in this position since July 2008. Mr. Saladrigas also serves as Chairman of Concordia Healthcare Holdings, LLC, which specializes in managed behavioral health, since January 2011. He served as Vice Chairman, from 2007 to 2008, and Chairman, from 2002 to 2007, of Premier American Bank in Miami, Florida. Mr. Saladrigas served as Chief Executive Officer of ADP Total Source (previously the Vincam Group, Inc.) from 1984 to 2002. |

Majority Voting for the Election of Directors

Under the Amended and Restated By-Laws, in an uncontested election at which a quorum is present, a director-nominee will be elected if the number of shares voted "FOR" the nominee's election exceeds the number of votes withheld from that nominee's election. In addition, the Company has a resignation policy in its Principles for Corporate Governance which requires an incumbent Director who has more votes withheld from that nominee's re-election than votes "FOR" his or her re-election to tender his or her letter of resignation for consideration by the Corporate Governance Committee of the Company's Board of Directors.

In contested elections, Directors will continue to be elected by plurality vote. For purposes of the Amended and Restated By-Laws, a "contested election" is an election in which the number of nominees for director is greater than the number of directors to be elected.

The Board of Directors Recommends a Vote "FOR" Each Nominee.Nominee.

20 DUKE ENERGY – 2014 Proxy Statement

| 18 DUKE ENERGY – 2015 Proxy Statement | | |

Table of Contents

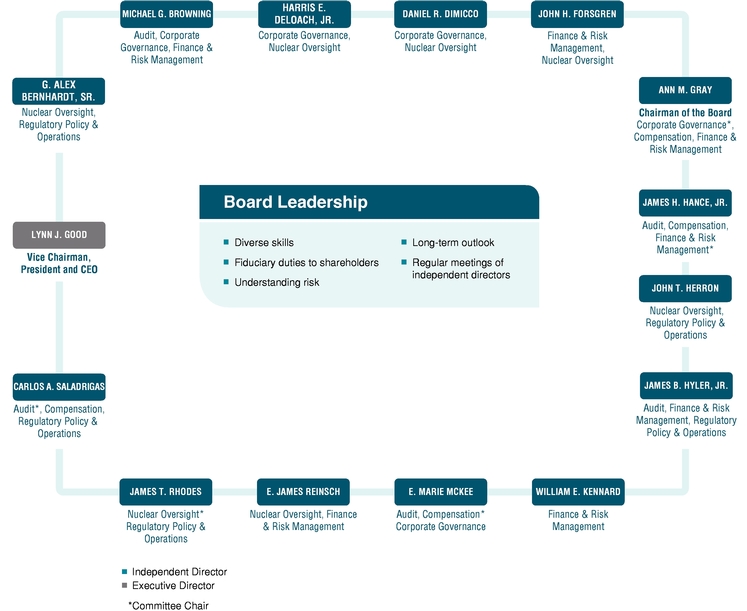

INFORMATION ON THE BOARD OF DIRECTORS

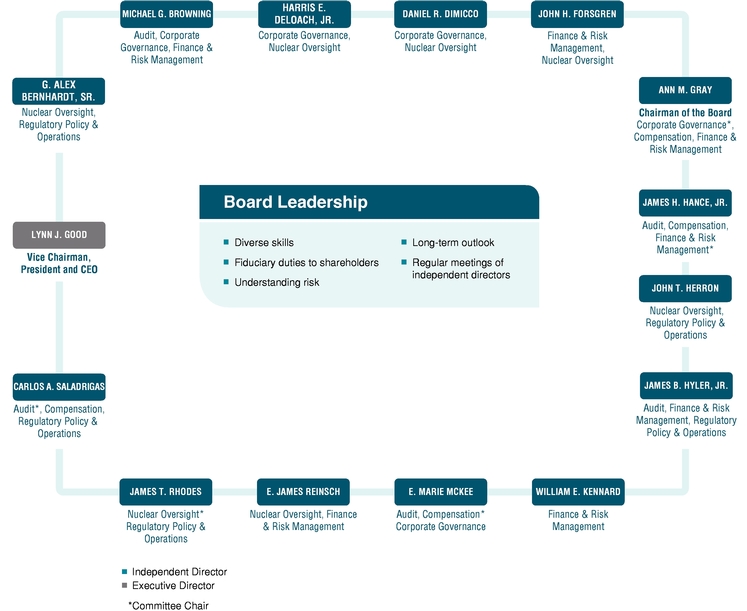

Our Board Leadership

Our Board of Directors is currently structured with an independent Chairman of the Board and a separate Vice Chairman who is also our President and Chief Executive Officer. On January 1, 2014,December 31, 2013, Ann Maynard Gray, previously the Company's independent lead director, became Chairman of the Board. Our President and Chief Executive Officer, Lynn Good, assumed the role of Vice Chairman in July 2013.

The Board of Directors believes that the Company and its shareholders are best served by the Board retaining discretion to determine the appropriate leadership structure for the Company based on what it believes is best for the Company at a particular point in time, including whether the same individual should serve as both Chief Executive Officer and Chairman of the Board, or whether the roles should be separate. In the event that the Board of Directors determines that the same individual should hold the positions of Chief Executive Officer and Chairman of the Board, the Company's Principles for Corporate Governance provide for an independent lead director to be appointed from among the independent directors.

Our independent Chairman of the Board presides at the regularly scheduled executive sessions of the non-management/independent directors.

Director Attendance

The Board of Directors of Duke Energy met 1011 times during 20132014 and has met 34 times so far in 2014.2015. The overall attendance percentage for our directors was approximately 95%98% in 2013,2014, and no director attended less than 75% of the total of the Board of Directors' meetings and the meetings of the committees upon which he or she served in 2013.2014. Directors are encouraged to attend the annual shareholder meeting.Annual Meeting of Shareholders. All members of the Board of Directors attended Duke Energy's last annual shareholder meetingAnnual Meeting of Shareholders on May 2, 2013.1, 2014.

Risk Oversight

The Board of Directors is actively involved in the oversight of risks that could affect Duke Energy. This oversight is conducted primarily through the Finance and Risk Management Committee of the Board but also through the other committees of the Board, as appropriate. See below for descriptions of each of the committees. The Board and its committees, including the Finance and Risk Management Committee, satisfy its risk oversight responsibility through reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within Duke Energy.

Independence of Directors